Gambling News 19 September 2024

Wynn Investors Receive $70M in Securities Fraud Lawsuit

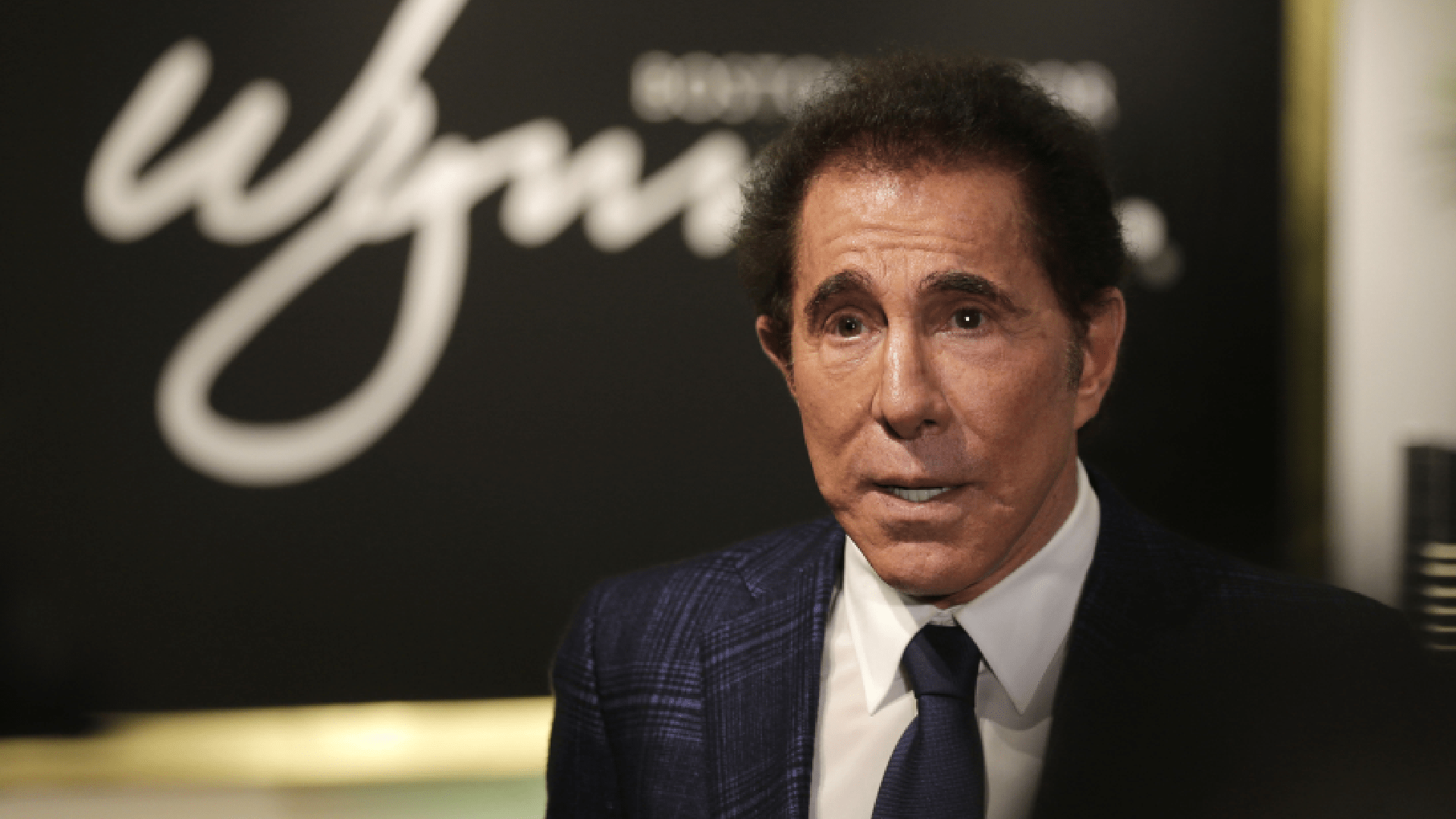

Wynn Resorts (NASDAQ: WYNN) and several ex-executives of the gaming firm have consented to pay $70 million to investors for their purported involvement in concealing the sexual misconduct of founder and former CEO Steve Wynn. The defendants will contribute $9.4 million of that total, while insurance companies will cover the rest.

Earlier this week, Pomerantz LLP submitted a motion requesting the US District Court for the District of Nevada to grant initial approval of the settlement in the case Ferris, et al. v. Wynn Resorts Ltd., et al. Acting on behalf of the plaintiffs in the class action, Pomerantz asserted that certain former Wynn executives concealed Steve Wynn’s sexual misconduct, creating “material misrepresentations to shareholders between March 28, 2016, and March 12, 2018.”

"The complaint alleged defendants were aware of numerous allegations of sexual misconduct made against Wynn over the course of several decades and defendants repeatedly denied those allegations and helped to cover them up,” according to a statement issued by the law firm.

Steve Wynn is generally regarded as the inaugural prominent executive whose wrongdoings were revealed by the "Me Too" movement. A Wall Street Journal article from January 2018, allegedly influenced by Elaine Wynn — Steve’s former spouse — outlined the gaming executive's misconduct toward several female staff members, leading to his removal from the company he established.

Wynn Securities Fraud Litigation is Important

In numerous cases, class-action lawsuits filed by attorneys representing dissatisfied shareholders fail because courts frequently decide that shareholders, in return for possible benefits from a company's stock, accept risk.

Taking on risk is one aspect, but when it’s exacerbated by the wrongdoing of executives, it allows courts to decide in favor of plaintiffs. Wynn's share price movement affirmed this.

In the specified period from March 2016 to March 2018, gaming equity almost doubled, enabling Steve Wynn to sell his shares at advantageous prices. By June 2018, the stock began to decline noticeably as the Massachusetts Gaming Commission (MGC) and the Nevada Gaming Control Board (NGCB) initiated inquiries into activities at Wynn.

“These events led to a drop in Wynn Resorts’ share price, which caused significant damage to the company’s shareholders,” added Pomerantz.

That statement is correct as, in Massachusetts, the gaming firm faced $35.5 million in fines, with $500K imposed on then-CEO Matt Maddox, who succeeded Steve Wynn. Before those penalties were imposed, there was widespread conjecture regarding the gaming company's capacity to keep its operating license for Encore Boston Harbor and whispers that it could be compelled to sell the casino hotel to a competitor. Although that talk turned out to be untrue, it impacted the stock price negatively.

Maddox, general counsel Kim Marie Sinatra, and former CFO Stephen Cootey were included among the executives listed in the lawsuit. Maddox departed from the gaming company on February 1, 2022. Cootey is currently working for Red Rock Resorts.

“This case should serve as a warning to corporations and their officers that talk is not, in fact, cheap,” said Pomerantz partner Murielle Steven Walsh in the press release. “Investors care about corporate integrity and accountability, and companies that are accused of making statements to cover up or deny allegations of serious misconduct by executives face a potentially steep financial reckoning.”

Busy Season for Wynn Legal Updates

The announcement of the Wynn settlement with investors came just under two weeks after the company revealed it had struck a deal with the Department of Justice (DOJ) to pay $130.13 million and acknowledge wrongdoing in a prolonged, unregulated money transfer operation that occurred at Wynn Las Vegas.

The DOJ stated that this is the biggest penalty ever imposed on a single US gaming establishment. In accordance with a nonprosecution agreement (NPA), the gaming firm was required to acknowledge breaches of anti-money laundering regulations.

On September 10, Wynn Resorts revealed the issuance of $800 million in corporate bonds, informing investors that the funds will be utilized to eliminate debt due next year and to settle the penalty with the federal government.

Related articles

Read some iteresting and relatable articles abaout casino.

Try These Casinos

Fruit Kings

Deposit £10 or more and

receive a 100% deposit bonus up to £50 PLUS 100 spins on Book of Dead

18+. New players only. 100% bonus on first deposit up to £50 & 100 Bonus Spins (50 spins on day 1, 25 on day 2, 25 on day 3) for Book of Dead slot only. Min first deposit of £20. Max bonus £50. Max bonus bet £5. Max bonus cash-out £250. 40x wagering requirements. Bonus expiry 30 days. Bonus spins expire after 48 hours. Game restrictions apply. Further Terms Apply.